On March 6, 2024, almost two years after the Securities and Exchange Commission’s (SEC) proposed amendments “to enhance and standardize climate-related disclosures for investors,” the SEC adopted a final rule on climate-related disclosures. The final rule requires public companies to provide qualitative and quantitative disclosure under Regulation S-K and Regulation S-X in annual reports and registration statements related to:

-

material climate-related risks and climate-related opportunities to mitigate or adapt to such risks;

-

the impact of climate-related risks on a company’s strategy, business model, and outlook;

-

the role of management and the board of directors in managing climate-related risks and opportunities;

-

climate-related targets and goals that are material to a company’s business, results of operations, or financial condition;

-

Scope 1 and 2 greenhouse gas (GHG) emissions;

-

the filing of an attestation report covering the required disclosure of a company’s Scope 1 and/or Scope 2 emissions; and

-

disclosure of the financial statement effects of severe weather events and other natural conditions.

According to the SEC, the rule reflects their “efforts to respond to investors’ demand for more consistent, comparable, and reliable information about the financial effects of climate-related risks on a registrant’s operations and how it manages those risks while balancing concerns about mitigating the associated costs of the rules.” The final rule includes significant changes from the proposed amendments, including, among other things:

-

eliminating the proposed requirement to disclose a company’s Scope 3 GHG emissions;

-

limiting the disclosure obligation related to Scope 1 and Scope 2 emissions to large accelerated filers and accelerated filers, and only when those emissions are material and with the option to provide the disclosure on a delayed basis, and exempting emerging growth companies and smaller reporting companies from such obligations;

-

eliminating the proposed requirement to describe board members’ climate expertise;

-

modifying the proposed assurance requirement covering Scope 1 and Scope 2 emissions for large accelerated filers and accelerated filers by extending the reasonable assurance phase-in period for large accelerated filers and requiring only limited assurance for accelerated filers;

-

the further qualification of the climate-related disclosures by materiality;

-

the scaling back of climate-related disclosure to be included in companies’ financial statements by, among other things, removing the requirement to disclose the impact of severe weather events and other natural conditions and transition activities on each line item of a company’s consolidated financial statements;

-

eliminating the proposed requirement to disclose any material change to the climate-related disclosures provided in a registration statement or annual report in a company’s quarterly report on Form 10-Q (or, in certain circumstances, Form 6-K for foreign private issuers that do not report on domestic forms); and

-

extending a safe harbor from private liability for certain disclosures, other than historical facts, pertaining to a company’s transition plan, scenario analysis, internal carbon pricing, and targets and goals in addition to existing safe harbors for forward-looking statements under the federal securities laws.

Given the complexity of the new rules and the anticipated costs of compliance with these climate-related disclosures, the rules are already under legal scrutiny. Multiple lawsuits have been filed challenging the SEC’s authority to promulgate the rules and claiming the rules are arbitrary and capricious under the Administrative Procedures Act, which is expected to impact the scope of the rules and the implementation timing. On Friday, March 15, 2024, the U.S. Court of Appeals for the Fifth Circuit granted a temporary stay with respect to implementation of the new rules.

This SEC Alert provides a brief summary of the requirements under the final rule for climate-related disclosures.

Regulation S-K

The final rule adds new subpart 1500 to Regulation S-K that requires disclosures regarding the following matters, among others:

-

Identification of climate-related risks that have had or are reasonably likely to have a material impact on a company’s business strategy, results of operations, or financial conditions in the short- and long-term;

-

Evaluation of the actual and potential material impacts of climate-related risks on a company’s strategy, business model, and outlook;

-

A quantitative and qualitative description of material expenditures incurred and material impacts on a company’s financial estimates and assumptions that directly result from a company’s activities undertaken to mitigate or adapt to material climate-related risk as part of such company’s strategy;

-

In the event a company engages in activities to mitigate or adapt to a material climate-related risk, specific disclosures will be required regarding such activities, including the use, if any, of a transition plan, scenario analysis, or internal carbon prices and the impact of such activities on such company’s business, results of operations or financial condition;

-

Oversight of climate-related risks by the company’s board of directors and the role of management in assessing and managing the company’s material climate-related risks;

-

Identification, assessment, and management of material climate-related risks through company processes and descriptions of how those processes are integrated into enterprise risk management systems;

-

Information about climate-related targets and goals that have or are likely to have a material effect on the company’s business, results of operations, or financial condition;

-

Identification of Scope 1 and Scope 2 GHG emissions metrics material to the company’s business and operations for large accelerated filers and non-exempt accelerated filers, as well as an assurance report at the reasonable assurance level for large accelerated filers (following a phase-in period) and at the limited assurance level for accelerated filers;

-

Calculation of capitalized costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions;

-

Calculation of capitalized costs, expenditures, and losses related to carbon offsets and renewable energy credit certificates if material to the company’s climate-related targets or goals; and

-

Evaluation of the effects of risks and uncertainties associated with severe weather events and other natural conditions on the estimates and assumptions used to produce the company’s financial statements.

The final rule requires companies to file these climate-related disclosures in their registration statements and annual reports. Except for disclosures related to Scope 1 and Scope 2 GHG emissions, climate-related disclosure should be included in the sections titled Risk Factors, Description of Business, Management’s Discussion and Analysis of Financial Condition and Results of Operations, or other appropriate sections of the applicable registration statement or annual reports.

Large accelerated filers and accelerated filers that are not otherwise exempted and are required to include disclosure about material Scope 1 and Scope 2 GHG emission in the company’s annual report on Form 10-K but may include such disclosure in the quarterly report on Form 10-Q for the second fiscal quarter immediately following the year in which the GHG metrics disclosure relates incorporated by reference into the Form 10-K, or an amendment to the Form 10-K that is filed no later than the due date for the Form 10-Q for its second fiscal quarter. In addition, as noted above, large accelerated filers and accelerated filers are required to file an attestation report providing certain assurances of their disclosure of Scope 1 and Scope 2 GHG emissions based on the company’s filer status.

Regulation S-X

The final rule amends Regulation S-X to require companies to disclose in the notes to their financial statements disaggregated financial metrics on climate-related risks, including certain expenditures, costs, charges, and losses incurred to mitigate the risks related to severe weather events and other natural conditions, subject to 1% and deminimis disclosure thresholds. Companies are also required to provide contextual information to these climate-related disclosures in the notes to the financial statements, such as the estimates and assumptions made to calculate the disclosures and whether any of the estimates and assumptions were materially impacted by risks related to severe weather events and other natural conditions or any climate-related targets or transition plans.

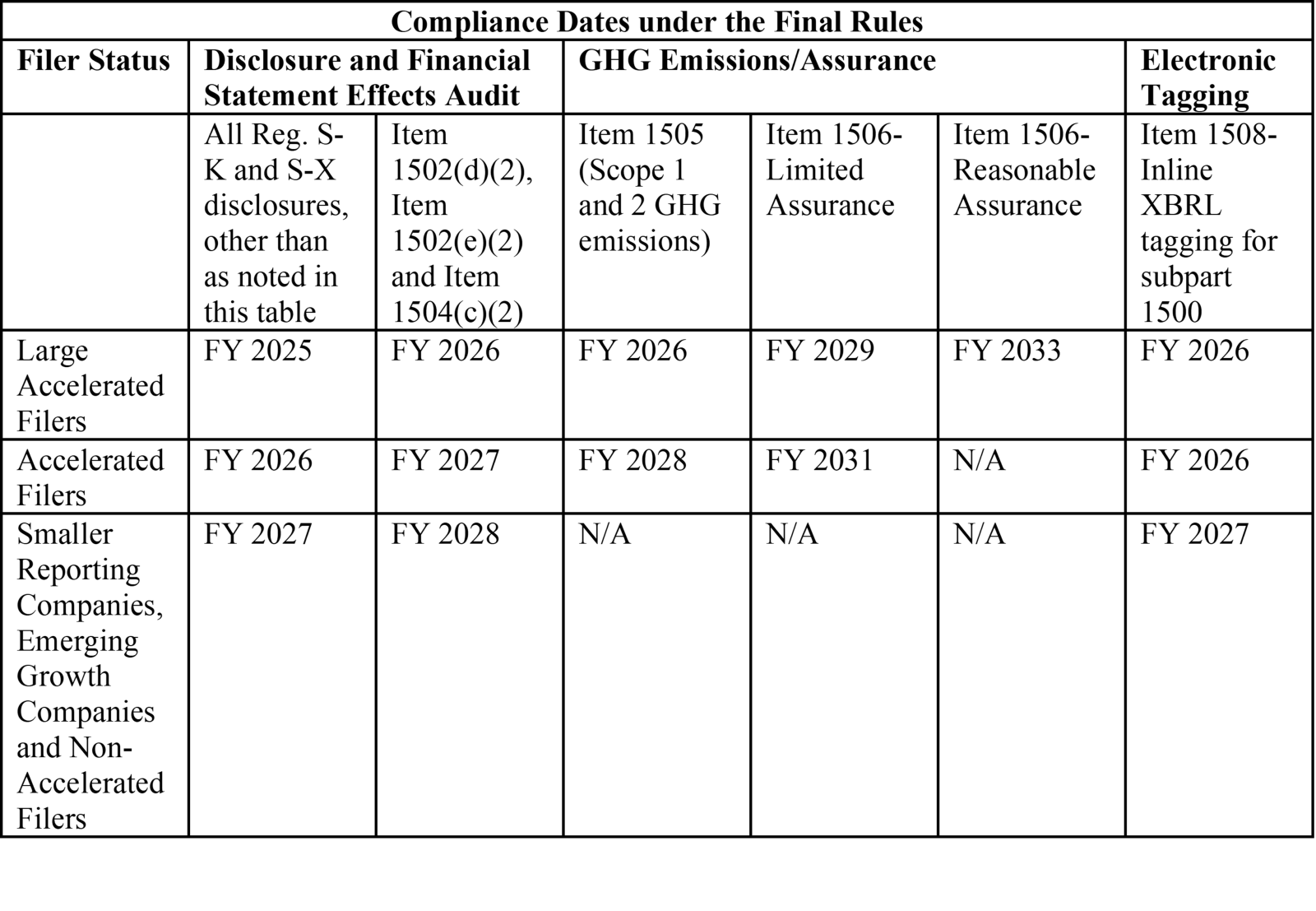

Compliance Dates

Compliance with the final rules will be phased in based on the company’s status as a large accelerated filer, accelerated filer, non-accelerated filer, or smaller reporting company, as demonstrated below: