On December 14, 2022, the Securities and Exchange Commission (SEC) adopted amendments to Rule 10b5-1 (Rule 10b5-1) under the Securities Exchange Act of 1934, as amended (Exchange Act) that provides an affirmative defense to trading on the basis of material nonpublic information (MNPI) pursuant to plans that are intended to meet the conditions of Rule 10b5-1 (10b5-1 plans). The SEC also adopted new disclosure requirements regarding insider trading policies, the adoption and termination of 10b5-1 plans, and option or option-like awards made close in time to the registrant's release of MNPI. In addition, the SEC amended Section 16 of the Exchange Act to require reporting persons to identify transactions made pursuant to a 10b5-1 plan on Forms 4 and 5 and to require disclosure of bona fide gifts of equity securities on Form 4.

The new rules will become effective 60 days following publication in the Federal Register. Registrants will be required to comply with the new rules in their periodic reports on Form 10-Q, Form 10-K, Form 20-F, and in any proxy statements, as applicable, in the first filing that covers the first full fiscal period that begins on or after April 1, 2023, which for December 31 fiscal year registrants would require compliance beginning with their second quarter Form 10-Q in 2023. Registrants that are smaller reporting companies will have until the first filing that covers the first full fiscal period that begins on or after October 1, 2023. Section 16 reporting persons will be required to comply with the applicable amendments on or after April 1, 2023. Finally, the amendments to Rule 10b5-1 will not affect the affirmative defense available under existing 10b5-1 plans that were entered into prior to the effective date of the new rules, except to the extent that such plans are modified after the effective date of the new rules.

The final rule release is available here, and the SEC’s fact sheet is available here.

Background

The SEC adopted Rule 10b5-1 in August 2000 as a means to provide company “insiders,” namely, company directors, officers, and other individuals who may be in a position to possess, or have access to, MNPI on an ongoing basis, the ability to trade in company securities without violating insider trading laws. Insiders regularly come into possession of MNPI in the normal course of their duties, which makes it difficult to transact in securities of their employer without running afoul of insider trading prohibitions. When an insider purchases or sells securities while aware of MNPI about that security or its issuer, the insider is considered to have traded “on the basis of” MNPI and will become subject to insider trading scrutiny. Adopting a valid 10b5-1 plan allows insiders to establish an affirmative defense to insider trading.

In order to trade under a valid 10b5-1 plan, certain conditions are required to be met as originally adopted in Rule 10b5-1, specifically:

-

the individual must have adopted the 10b5-1 plan in good faith prior to becoming aware of MNPI;

-

the 10b5-1 plan must specify the amount, price, and date of securities to be purchased or sold; provide written instructions or a formula for determining the amount of securities to be purchased or sold, including the price at which and date on which the securities are to be purchased or sold; or not allow the individual to influence how, when, or whether trades are made once a 10b5-1 plan is established, provided that the 10b5-1 plan is established when the individual is not aware of MNPI; and

-

the purchases or sales of securities must be executed pursuant to the 10b5-1 plan only.

Companies themselves are also permitted to enter into 10b5-1 plans, for example, when they begin a stock repurchase program, and must follow the same restrictions noted above.

Overview of the Amendments

According to the SEC, the new conditions to Rule 10b5-1 “are designed to address concerns about abuse of the rule to trade securities opportunistically on the basis of [MNPI] in ways that harm investors and undermine the integrity of the securities markets.”

As discussed in more detail below, the amendments adopted by the SEC will:

-

amend the affirmative defense of Rule 10b5-1 to:

-

include a cooling-off period applicable to directors and officers and a shorter cooling-off period applicable to all other persons other than the company;

-

include a certification condition for directors and officers in 10b5-1 plans;

-

limit the ability of persons other than the company to use multiple overlapping 10b5-1 plans;

-

limit the ability of individuals to rely on the affirmative defense for a single-trade plan to one single-trade plan during any consecutive 12-month period; and

-

add a condition that all individuals entering into a 10b5-1 plan must act in good faith with respect to that plan;

-

require:

-

quarterly disclosure regarding the use of 10b5-1 plans and certain other trading arrangements by a registrant’s directors and officers; and

-

annual disclosure regarding insider trading policies and procedures;

-

require certain tabular and narrative disclosures regarding awards of options, stock appreciation rights (SARs), and/or similar option-like instruments granted to corporate insiders shortly before and immediately after the release of MNPI;

-

require inline XBRL tagging of the new quarterly disclosure regarding the use of 10b5-1 plans and the new tabular disclosure regarding option and option-like awards;

-

add a mandatory Rule 10b5-1 checkbox to Forms 4 and 5; and

-

require reporting of dispositions of securities by bona fide gifts on Form 4 rather than on Form 5.

Cooling-off Period

As originally adopted, the conditions for 10b5-1 plans in Rule 10b5-1 did not include a “cooling-off” period between a 10b5-1 plan’s adoption and the first trade pursuant to the plan. To address concerns about entry into 10b5-1 plans while in possession of MNPI, best practice has been to include a cooling-off period. However, the length of the cooling-off period often varies and is sometimes as short as two weeks.

In order to provide separation in time between the adoption of a 10b5-1 plan and the commencement of trading under such plan so as to minimize the ability of an individual to benefit from any MNPI, the new conditions to Rule 10b5-1 will require a cooling-off period. Pursuant to the new conditions, if the individual entering into the 10b5-1 plan is:

-

a director or officer of the registrant, the cooling-off period will expire upon the later of (i) 90 days after the adoption of the 10b5-1 plan or (ii) two days following the release of the registrant's financial results in a Form 10-Q or Form 10-K for the completed fiscal quarter in which the 10b5-1 plan was adopted, or for foreign private issuers, in Form 20-F or a Form 6-K that discloses the registrant's financial results, but in any event, subject to a maximum of 120 days after the adoption of the 10b5-1 plan; or

-

not a director or officer, the cooling-off period will expire 30 days after the adoption of the 10b5-1 plan.

As adopted, the new cooling-off period condition will not apply to 10b5-1 plans adopted by a registrant.

Additionally, the new conditions specifically provide that any modification or change to the amount, price, or timing of the purchase or sale of the securities underlying a 10b5-1 plan is considered a termination of such plan and, therefore, the adoption of a new 10b5-1 plan that will trigger a new cooling-off period requirement.

Director and Officer Certifications

In order to “reinforce directors’ and officers’ cognizance of their obligation not to trade or adopt a trading plan while aware of [MNPI], their responsibility to determine whether they are aware of [MNPI] when adopting [10b5-1 plans] and the fact that the affirmative defense under Rule 10b5-1 requires them to act in good faith and not to adopt such plans as part of a plan or scheme to evade insider trading laws,” the new conditions to Rule 10b5-1 will require directors and officers to include a representation in their 10b5-1 plans certifying that at the time of the adoption of a new or modified 10b5-1 plan:

-

they are not aware of MNPI about the registrant or its securities; and

-

they are adopting the 10b5-1 plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1.

Restricting Multiple Overlapping Rule 10b5-1 Plans and Single Trade Plans

Currently, an individual can adopt multiple overlapping 10b5-1 plans and then terminate plans based on MNPI or market conditions. Under the new conditions to Rule 10b5-1, an individual entering into a 10b5-1 plan will not be permitted to have another 10b5-1 plan outstanding, subject to limited exceptions. Those exceptions include:

-

an individual will be permitted to have separate 10b5-1 plans with different brokers acting on the individual’s behalf provided that the plans, when taken as a whole, meet all of the conditions to Rule 10b5-1, including that a modification of any individual 10b5-1 plan will act as a modification of the other 10b5-1 plans; provided that the substitution of a broker for another broker that is executing trades pursuant to a 10b5-1 plan will not be considered a modification of a plan so long as the purchase or sales instructions applicable to the substitute and substituted broker are identical with respect to the price at which, the date on which and the amount of the securities are to be purchased or sold;

-

an individual will be permitted to maintain two separate 10b5-1 plans at the same time so long as trading under the later-commencing plan will not begin until after all trades under the earlier-commencing plan are completed or expire without execution; provided that the first trade under the later-commencing plan does not occur before the expiration of the cooling-off period that would be applicable for the later-commencing plan, with the date of adoption of the later-commencing plan being deemed to be the date of termination of the earlier-commencing plan; and

-

a 10b5-1 plan for eligible sell-to-cover transactions, where only such securities as necessary to satisfy tax withholding obligations arising exclusively from the vesting of a compensatory award such as restricted stock or SARs, will not be considered an outstanding additional 10b5-1 plan provided the individual does not otherwise exercise control over the timing of such sale. (Note this exception will not include sales incident to the exercise of option awards.)

In addition to the restriction on multiple overlapping plans, an individual will be able to rely on the affirmative defense under Rule 10b5-1 for only one single-transaction 10b5-1 plan during any 12-month period, and only if the individual did not have another single-transaction 10b5-1 plan during the prior 12-month period.

As noted above, the restrictions on multiple overlapping and single transaction 10b5-1 plans will not apply to 10b5-1 plans adopted by a registrant.

Amended Good Faith Condition

Currently, the Rule 10b5-1 affirmative defense is only available if a trading plan was entered into in good faith and not as part of a plan or scheme to evade the prohibitions of the rule. Based on the SEC’s concern that insiders may take actions to benefit from MNPI they acquire after adopting a 10b5-1 plan, a new condition will be added that the person adopting the 10b5-1 plan “has acted in good faith with respect to” the plan.

Disclosure Regarding 10b5-1 Plans and Certain Awards

Currently, there are no mandatory disclosure requirements with respect to the use of 10b5-1 plans by registrants or their directors or officers. Under the new rules, the SEC has adopted several new disclosure requirements with respect to 10b5-1 plans and related matters. The first is a new Item 408(a) of Regulation S-K that will require registrants to:

-

disclose whether, during the last fiscal quarter, any director or officer has adopted or terminated any 10b5-1 plan and/or any written trading arrangement for the purchase or sale of securities of the registrant that meets the requirements of a non-Rule 10b5-1 trading arrangement, as defined in new Item 408(c); and

-

provide a description of the material terms of the 10b5-1 plan or non-Rule 10b5-1 trading arrangement other than terms with respect to the price at which the individual executing the respective trading arrangement is authorized to trade, such as:

-

the name and title of the director or officer;

-

the date of adoption or termination of the trading arrangement;

-

the duration of the trading arrangement; and

-

the aggregate number of securities to be sold or purchased under the trading arrangement.

The SEC has also adopted a new Item 408(b) of Regulation S-K and Item 16J in Form 20-F that will require registrants to disclose whether they have adopted insider trading policies and procedures that are reasonably designed to promote compliance with insider trading laws. If the registrant has not adopted such policies and procedures, it will be required to explain why it has not done so. If a registrant has adopted such insider trading policies and procedures, the amendments adopted by the SEC will also require the registrant to file a copy of such policies and procedures as an exhibit to its Form 10-K or Form 20-F, as applicable.

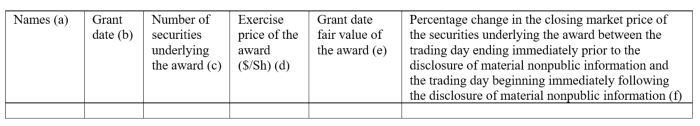

Finally, the SEC has adopted a new Item 402(x) of Regulation S-K (Item 402(x)), which will require registrants to discuss their policies and practices on the timing of awards of options, SARs, or similar option-like instruments in relation to the disclosure of MNPI, including how the board determines when to grant such awards; whether the board takes MNPI into account when determining the timing and terms of such an award, and, if so, how the board takes MNPI into account when determining the timing and terms of such an award; and whether the registrant has timed the disclosure of MNPI for the purpose of affecting the value of executive compensation. Additionally, if during the last completed fiscal year, the registrant awarded options, SARs, or similar option-like instruments to a named executive officer in the period beginning four business days before the filing of a Form 10-Q or Form 10-K or the filing or furnishing of a current report on Form 8-K that discloses MNPI, and ending one business day after the filing or furnishing of such report, the registrant must provide the following tabular disclosure:

-

the name of the named executive officer;

-

on an award-by-award basis, the grant date of the option award reported

-

on an award-by-award basis, the number of securities underlying the options;

-

on an award-by-award basis, the per-share exercise price of the options;

-

on an award-by-award basis, the grant date fair value of each award computed using the same methodology as used for the registrant’s financial statements; and

-

the percentage change in the market price of the underlying securities between the closing market price of the security one trading day prior to and the trading day immediately following the disclosure of any material nonpublic information.

The disclosure provided under the new Items 402(x), 408, and 16J must also be inline XBRL tagged.

Amendments to Form 4 and Form 5

Section 16(a) of the Exchange Act requires that every person who is an officer or director of the issuer of the security or who beneficially owns more than 10% of any class of equity security registered under Section 12 of the Exchange Act (Section 16 reporting persons) must file with the SEC an initial report disclosing the amount of all equity securities of such issuer of which the filer is the beneficial owner (on Form 3) and must file subsequent reports to disclose any changes in beneficial ownership (on Form 4 or Form 5). In order to help the public better understand how 10b5-1 plans are being used by Section 16 reporting persons, the SEC has adopted changes to Forms 4 and 5 to include a new mandatory checkbox to indicate that a transaction was made pursuant to a 10b5-1 plan.

Additionally, the SEC adopted changes to the reporting of “bona fide gifts.” Currently, Section 16 reporting persons may report any “bona fide gift” of equity securities registered under Section 12 of the Exchange Act on Form 5, which form must be filed within 45 days after the issuer’s fiscal year-end. The SEC noted that the delayed reporting of gifts may allow reporting persons to “engage in problematic gifts of equity securities, such as making gifts while in possession of [MNPI] or backdating stock gifts in order to maximize the tax benefits associated with such gifts.” The new amendments will require Section 16 reporting persons to report dispositions of bona fide gifts of equity securities on Form 4 (instead of Form 5) in accordance with Form 4’s filing deadline, which is before the end of the second business day following the date of execution of the transaction.

Next Steps

Registrants should start assessing the implications of the amendments as they pertain:

-

to any 10b5-1 plans currently in effect or contemplated for any of their directors and officers or 10b5-1 plans the registrant may have, and

-

to the disclosure requirements for their future SEC filings, and consult with counsel regarding the same.

Registrants should also use the time prior to the effective date of the new rules to review their existing insider trading policies and procedures and evaluate whether any updates or modifications are warranted in light of the amendments. Individuals with existing 10b5-1 plans should also contact their legal or financial advisors to discuss the impact these amendments will have, if any, on their plans with respect to the modification or termination of such plans or the adoption of a new 10b5-1 plan.